japan corporate tax rate 2020

Income from 1950001 to 3300000. The corporate tax rate in Japan for a branch is the same as for a subsidiary.

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

The tax treaty with Brazil provides a 25 tax rate for certain royalties trademark.

. 2020 Japan tax reform outline. 55 of taxable income. Our company registration advisors in Japan can deliver more details related to the corporate tax in this country.

Film royalties are taxed at 15. Tax year beginning between 1 Apr 201631 Mar 2017. Historical corporate tax rate data.

13 February 2020 Japan tax newsletter Ernst Young Tax Co. Indirect tax rates individual income tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by. Under Japanese corporation tax law the worldwide tax system is adopted and domestic corporations 5 are subject to corporation tax on their worldwide income.

Domestic income tax. Corporate Tax Rates around the World 2020. Corporate tax rate in japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

50 of taxable income. Japan Income Tax Tables in 2020. Worldwide tax system prior to 2017.

The corporate income tax is a tax on the profits of corporations. And b approximately 35 with a certain favourable rate for up to the first eight. Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of 334 Table 3-5 applies.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. The tax rates for corporate tax corporate inhabitant tax and enterprise tax on income tax burden on corporate income and per capita levy. The combined nominal rate of corporation tax and local corporation tax national taxes is 2559 and the effective corporation tax rate national and local combined is.

Corporate tax rate in japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Corporate Taxation in Japan. Japan Highlights 2020 Page 2 of 10 Rate The national standard corporation tax rate of 232 applies to ordinary corporations with share capital exceeding JPY 100 million.

Tax year beginning between 1 Apr 201731 Mar 2018. 60 of taxable income. Japan corporate tax rate deloitte.

The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a share capital which exceeds JPY 100 million USD 896387. A approximately 31 for large companies ie companies with a stated capital of more than 100 million yen. 2 Japan tax newsletter 13 February 2020 Corporate taxation 1.

Taxable Income Tax Rate less than 195 million yen 5 of taxable income 195 to 33 million yen 10 of taxable income minus 97500 yen 33 to 695 million yen 20 of taxable income minus 427500 yen 695 to 9 million yen 23 of taxable income minus 636000 yen 9 to 18 million yen. Taxation in Japan 2020. 41 what is the headline rate of tax on corporate profits.

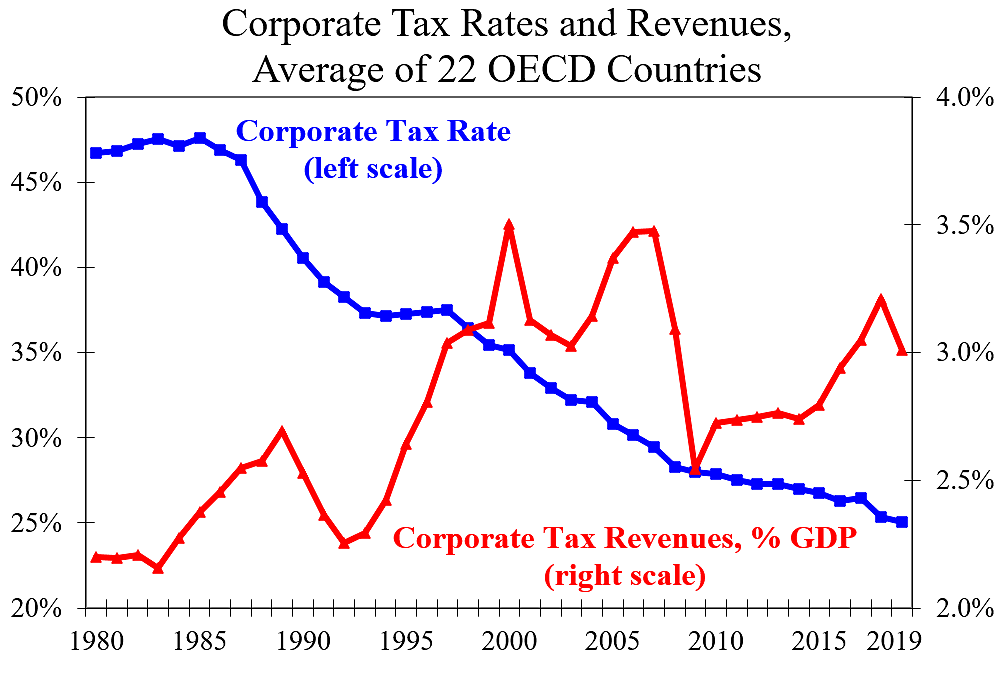

225 rows Since then countries have recognized the impact that high corporate tax rates have on business investment decisions so that in 2020 the average is now 2385 percent and 2585 when weighted by GDP for 177 separate tax jurisdictions. GIG is a specialist group established to respond to the various needs of foreign companies developing business in Japan. KPMGs corporate tax rates table provides a view of corporate tax rates around the world.

41 rows Corporate Tax Rate in Japan remained unchanged at 3062 in 2021. The tax rates applied to profit and loss sharing groups will be. However the WHT rate cannot exceed 2042 including the income surtax of 21 on any royalties to be received by a non-resident taxpayer of Japan under Japanese income tax law.

Income from 6950001 to 9000000. Diversity Equity Inclusion at Deloitte Japan. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

All OECD countries levy a tax on corporate profits but the rates and bases vary widely from country to country. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. National Income Tax Rates.

Tax rates for corporate income tax including historic rates and domestic withholding tax for more than 170 countries worldwide. Income from 0 to 1950000. Income from 3300001 to 6950000.

Tax year beginning after 1 Apr 2018. Comparing Europes Tax Systems. While the information contained in this booklet may assist in gaining a better understanding of the tax system in Japan it is recommended that specific advice be taken as to the tax.

2019 edition european smes are subjected to different taxes when doing business in japan. Companies also must pay local inhabitants tax which varies with the location and size of the firm. Income from 9000001 to 18000000.

Revision of the consolidated taxation. Beginning from 1 october 2019 corporate taxpayers are required to file and pay the national local corporate tax at a fixed rate of 103 of their corporate tax liabilities. The maximum rate was 524 and minimum was 3062.

Data is also available for. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019. But if the company is Medium and small sized company the taxable income limitation does not apply.

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Economics Corporation Tax Comparison Other Countries Corporate Tax Rate How To Plan Uk Companies

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Developing Country Gross Domestic Product Social Data

Corporate Tax Reform In The Wake Of The Pandemic Itep

Real Estate Related Taxes And Fees In Japan

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Corporate Income Tax Definition Taxedu Tax Foundation

Malta Corporate Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical Chart

Real Estate Related Taxes And Fees In Japan

Real Estate Related Taxes And Fees In Japan

일본 법인 세율 1993 2021 데이터 2022 2024 예상

Corporation Tax Europe 2021 Statista

Economics Corporation Tax Comparison Other Countries Corporate Tax Rate How To Plan Uk Companies

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Corporate Tax Reform In The Wake Of The Pandemic Itep

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates